Condominiums are sprouting from everywhere in the Metro. Thanks to the developers who are capitalizing from the low interest rate, and from the cash flows of Overseas Filipino Workers (OFWs) abroad and the employees of the Business Process Outsourcing (BPO) sector.

As a newbie condo buyer, it maybe easy for you to join the bandwagon and buy seemingly desirable condo property that is offered to you. Whether buying a condo is primarily for the purpose of residence or as a mean to generate passive income by renting it out, having a good condo strategy would give you a well-defined course of action. Below are some of the best condo investment strategies that you can apply if you are thinking of buying a condo.

Location is the key. The main advantage of a condo over house and lot is location. You’re investing in a condo because of it’s location, bringing you into a more convenient lifestyle. It may be near from your place of work or located in a prime location where you can cater to a lot of potential tenants. Since condos are mostly located near commercial areas, go there during rush hour traffic. Chances are, the estimated travel time in the marketing brochure you have seen will not take into account heavy traffic. Remember that you will need to travel during rush hour and travel time to and from your condo should be an important consideration.

Apart from the issue of traffic, try to pass by the location during heavy rains and check if flooding is an issue. In addition, aside from the location of the condo building itself, you should also consider the location of your unit within the building. If you work on the graveyard shift and need to sleep through the day, pick a unit on the upper floors so you can isolate yourself from the street noise. Units which are near the elevator or the garbage chute are cheaper for a reason – elevators opening and garbage plummeting down the chute make a lot of noise. Choose wisely not only the location of the building but your unit in the condo building as well.

Financing your condo. How are you going to pay your condo that you intend to buy? Are you going to pay in cash or borrow money for it? In answering this question, take note of your cash reserve and cash flow. Buying in cash can help you get a much better price because most developers offer significant discounts as an incentive for you to do so. However, make sure that you have enough cash reserve to fund your expenses in cases of emergency. Unlike paper assets such as stocks and mutual funds, a condo is not easy to sell and requires time to liquidate.

Meanwhile, if you are considering borrowing money from the bank to buy your condo, make sure that you have strong cash flow to pay for the monthly amortization. For those who are buying it for the purpose of renting it out for passive income, check the amortization amount versus the potential rental income. You may want to buy a condo with a significantly lesser monthly amortization amount than the potential monthly rental income for it to be a self-liquidating investment.

That being said, you should also consider the lower end of your average monthly cash flow before taking on a loan. A good gauge would be to have a surplus of about 10% to 20% of your average monthly cash outflows after subtracting the monthly amortization on the condo. Why? Not at all times, your condo unit is guaranteed to have a tenant as there may be times when your unit will be vacant. If you are able to save about 10% to 20% after subtracting the monthly amortization, you’ll have enough funds to cover for amortization during vacant times and to provide for you and your family’s needs.

There are other costs. You should be concerned not only to your monthly amortization but also to other expenses associated in owning a condo. Condominium buildings will also charge you monthly or annual condo dues for the maintenance of common areas of the building. This cost will vary depending on the size of your condo unit, and the type of services and amenities available to unit owners. Aside from condo dues, as a real estate property owner, you will also need to pay for annual real property taxes and insurance.

In addition to the monthly or annual costs, there maybe one-time payments needed that must also be considered when buying a condo. Most contract to sell will normally state that you will have to shoulder the costs of transfer tax and the registration of the condo title in your name. This should amount to no more than an additional 4% of your purchase price.

Read the fine print. For the common good of all unit owners, your condo will be governed by a deed of restrictions. The restrictions will dictate what you can and cannot do when you move in to your condo. Ask for a copy of the master deed and restrictions of the condo project and read through it. If you are a pet lover, you should know if the building will restrict or even prohibit pet ownership. Some condominium buildings may also prohibit the use of LPG.

The numbers don’t lie. When it comes to return on investment or ROI especially for those looking to rent out their condos for passive rental income, the numbers don’t lie. With a lot of condo projects that are on sale nowadays, given location as being equal, you might be asking yourself, shall I buy a brand new or a second hand condo unit? Let’s run the numbers.

If you want to ensure minimal vacancies for your unit, the best price to offer potential tenants is the lowest possible rate, inclusive of condo dues. For example, say you have the cash and you are thinking of buying a Php 1.5 million second hand unit versus a Php 2.5 million brand new unit.

If you rent out a second hand condo unit at Php 10,000 per month, inclusive of condo dues, at an average acquisition price of Php 1.5 million, your estimated annual ROI would be:

Annual ROI = Annual Rental Income ÷ Acquisition Cost

Annual ROI = [Monthly Rental x 12] ÷ Acquisition Cost

Annual ROI = [Php 10,000 x 12 months] ÷ Php 1,500,000.

Annual ROI = 8%.

However, if you bought a brand new condo unit at an average price of Php 2.5 million and you would like to earn at least the same ROI as the second-hand unit, you’ll need to rent it out at:

Monthly Rent = [Acquisition Cost x Annual ROI] ÷ 12 months

Monthly Rent = [Php 2,500,000.00 x 0.08] ÷ 12 months

Monthly Rent = Php 200,000 ÷ 12 months

Monthly Rent = Php 16,666 (inclusive of condo dues)

If you want to ensure minimal vacancies for your unit, the best price to offer potential tenants is the lowest possible rate, inclusive of condo dues. For example, say you have the cash and you are thinking of buying a Php 1.5 million second hand unit versus a Php 2.5 million brand new unit.

Now, put yourself in the shoes of ordinary office worker who would like to rent it to save on time and effort on commuting, which one will you choose? Chances are, you’ll go for the second hand because you will just basically use it as a shelter to eat, sleep and go to work.

Condominium investing is truly a good source of passive income. However, before you plunge your hard-earned money into it, make sure you are armed with your strategy so as to become a successful condo investor.

Must-have Condos at Iloilo Business Park

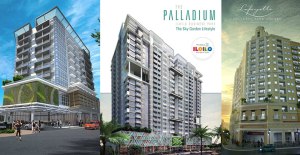

At Iloilo Business Park, Megaworld’s 72-hectare business township offers the most high-end residential condominium towers for those looking for near-perfection, if not, the classiest and most exciting in terms of amenities and location. Iloilo Business Park’s three most iconic residential towers are the contemporary-designed 3-tower One Madison Place, the vintage architectural-designed Lafayette Park Square and the 22-floor, sky-garden-lifestyle The Palladium. Each of these tower offers condominium units in various style and sizes, mood and vision, financing and payment mode that suits your needs, your passion and ensures your money’s worth when investing for a lifestyle you desired most. For more information, you may visit our showroom at the ground level of Richmonde Tower, 8 Enterprise Road, Iloilo Business Park, Mandurriao, Iloilo City or call (033) 3303462-65 or visit us at www.iloilobusinesspark.ph.

(Article source : http://www.millionaireacts.com/3246/condo-investment-strategies-and-tips-for-buyers.html)

Walang komento:

Mag-post ng isang Komento